An Initial Public Offering (IPO) is a significant milestone in a company’s life cycle, signaling its transition from a privately-held entity to a publicly traded company. Going public allows companies to raise capital, enhance their market presence, and provide liquidity for early investors. However, the IPO process is complex, requiring careful planning, regulatory approvals, and strategic decisions. In this article, we will break down the IPO process and explain how companies go public in the stock market.

What Is an IPO?

An IPO is the first time a company offers its shares to the public. By selling stock to the public for the first time, the company can raise funds for expansion, reduce debt, or invest in other growth initiatives. An IPO also allows private investors, employees, and company founders to sell some of their equity.

Once the IPO is completed, the company’s stock is traded on a stock exchange, such as the NYSE or NASDAQ. Going public provides companies with access to capital markets and opens up new avenues for funding.

Why Do Companies Choose to Go Public?

There are several reasons why companies pursue an IPO:

- Capital Raising: Companies often go public to raise funds for growth, acquisitions, or research and development.

- Enhanced Visibility and Credibility: Listing on a major stock exchange enhances the company’s visibility, credibility, and prestige in the market.

- Liquidity for Shareholders: An IPO offers early investors and employees an opportunity to cash out or diversify their holdings.

- Acquisitions and Stock-Based Compensation: Public companies can use their stock as currency for acquisitions or as part of employee compensation packages.

The IPO Process: Step-by-Step Breakdown

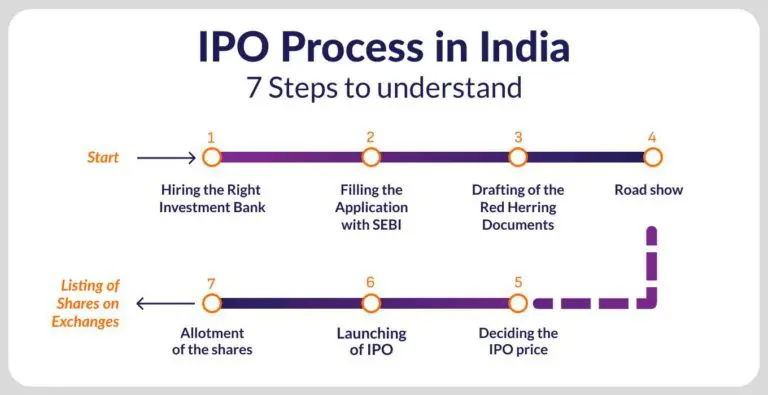

The IPO process involves multiple steps and collaboration with investment banks, regulators, and the company’s internal team. Here’s a breakdown of the key stages:

1. Decision to Go Public

The journey toward an IPO begins with the company’s decision to go public. This decision is typically made by the company’s board of directors in consultation with the management team. Factors such as the need for capital, growth opportunities, and market conditions will influence this decision.

2. Hiring Advisors and Underwriters

Once the decision is made, the company hires investment banks, known as underwriters, to manage the IPO. These underwriters play a critical role in pricing the stock, preparing the necessary filings, and marketing the IPO to investors.

Underwriters help the company with:

- Setting the IPO price range.

- Determining the number of shares to be offered.

- Conducting a roadshow to attract institutional investors.

3. Due Diligence and Filing with the SEC

The next step in the IPO process is preparing the necessary documentation. The company must file an S-1 registration statement with the Securities and Exchange Commission (SEC). The S-1 includes important information such as:

- Company history and business model.

- Financial statements and projections.

- Risks and uncertainties.

- Details about the offering, including the number of shares and pricing.

The SEC reviews this filing to ensure that it meets regulatory standards. During this time, the company and its underwriters will undergo a due diligence process, where they examine the company’s financials, operations, and other critical factors.

4. Pricing the IPO

Once the SEC has reviewed and approved the S-1 filing, the company and its underwriters will determine the IPO price. The offering price is the amount at which shares will be sold to investors during the initial public offering.

Several factors influence the IPO pricing, including:

- Demand from institutional investors: During the roadshow, the company and its underwriters gauge demand for the stock, which helps determine the price.

- Company valuation: The company’s financial health, growth prospects, and market conditions are all taken into account.

- Market conditions: Broader market trends, such as investor sentiment and economic outlook, can influence IPO pricing.

5. The Roadshow

Before the IPO goes live, the company embarks on a roadshow, which is a series of presentations to potential investors, primarily institutional investors. During this stage, company executives and underwriters present the company’s business model, financial performance, and growth prospects to encourage investment in the IPO.

The roadshow is crucial for generating interest and demand for the offering. It also allows the company to refine its pricing based on investor feedback.

6. Going Public and Trading Begins

After the roadshow, the IPO shares are offered to the public at the offering price. On the day of the IPO, the company’s stock officially begins trading on the stock exchange. Investors can now buy and sell shares of the company on the open market.

The stock’s price will likely fluctuate after the IPO, driven by supply and demand dynamics. Some IPOs experience a “pop” on their first day of trading, where the stock price increases significantly, while others may see their price decline.

7. Post-IPO: Compliance and Lock-Up Period

Once the IPO is completed, the company must comply with regulations set by the SEC. This includes filing regular quarterly and annual reports, including its 10-Q and 10-K filings, which provide insights into the company’s financial health.

Additionally, many IPOs have a lock-up period, usually lasting 90 to 180 days, during which company insiders (such as executives and early investors) are restricted from selling their shares. After the lock-up period ends, insiders can sell their shares, potentially impacting the stock price.

Advantages and Risks of IPOs

Advantages:

- Capital for Growth: The primary advantage of an IPO is the capital it raises, which can be used for expanding operations, paying off debt, or funding acquisitions.

- Public Market Visibility: Being publicly traded increases a company’s visibility, credibility, and ability to attract investment.

- Liquidity for Shareholders: IPOs provide liquidity options for early investors, employees, and founders.

Risks:

- Market Volatility: The stock price of a newly listed company may experience significant volatility in the early days of trading.

- Regulatory Scrutiny: As a public company, there is increased regulatory scrutiny, and companies must adhere to strict financial reporting and compliance standards.

- Costly Process: The IPO process is expensive, involving underwriting fees, legal costs, and other associated expenses.

Also Read: Understanding Ipos: A Beginners Guide To The Stock Markets Biggest Event

Final Thoughts

The IPO process is a significant event for any company, offering opportunities for capital, expansion, and greater market visibility. However, going public comes with both advantages and challenges, and companies must carefully evaluate the timing, pricing, and implications of an IPO.

For investors, IPOs present an exciting opportunity to invest in companies at the ground level, but they come with inherent risks. Understanding the IPO process, evaluating the company’s prospects, and being aware of market conditions are essential for making informed investment decisions.